Why The Automotive Industry Is Down: No Automotive Jobs and When Will It Become Normal Again?

Hello guys, welcome back to my blog. In this article, I will discuss why the automotive industry is down, no automotive jobs, and when it will become normal again.

Ask questions if you have any electrical, electronics, or computer science doubts. You can also catch me on Instagram – CS Electrical & Electronics

- In-Depth Guide To UDS Service 0x19 – ReadDTCInformation

- Testing Techniques For Test Case Writing in the Automotive Domain

- Different Storage Classes In MATLAB Simulink

Why The Automotive Industry Is Down

The automotive industry, once a symbol of industrial robustness and global employment, is currently navigating through a prolonged downturn. Engineers, technicians, designers, and even executives are experiencing job scarcity. With layoffs from top OEMs, frozen hiring in Tier 1 and Tier 2 suppliers, and the overall silence in automotive recruitment platforms, professionals are wondering: Why is this happening? When will things return to normal?

Historical Context of the Automotive Industry

Historically, the automotive sector has gone through multiple boom-bust cycles — from the oil crises of the 1970s to the global financial meltdown in 2008. However, today’s situation is unique. It’s not driven by one factor but rather a perfect storm of interlinked global events and disruptive transitions.

From combustion to electrification, manual manufacturing to automation, and the digital transformation of vehicles, the change is systemic and deep-rooted.

Key Reasons Behind the Downturn

a. Semiconductor Shortage:

One of the most cited reasons for the automotive industry’s slowdown is the semiconductor chip shortage. Modern vehicles require hundreds of microchips for everything from infotainment to safety systems. When the COVID-19 pandemic hit, chip production slowed while demand for electronics surged, leading to a bottleneck that persists even today.

b. Supply Chain Disruptions

From wiring harnesses in Ukraine to raw materials from China, the global supply chain is more fragile than ever. Disruptions in shipping, logistics, and raw material extraction have made it difficult for OEMs to meet production targets.

c. Economic Slowdowns & Inflation

Many countries are battling inflation and reduced consumer spending. Vehicles are expensive, and people are deferring purchases. High-interest rates on vehicle loans and fuel prices are pushing consumers to delay or cancel vehicle upgrades.

d. Transition to EVs & Digitalization

Legacy automotive companies are caught in a mid-way transformation phase. On one hand, they are expected to continue producing ICE vehicles to generate revenue, and on the other, they must invest heavily in Electric Vehicles (EVs), ADAS, and software-defined vehicles (SDVs).

e. Industry Consolidation & Layoffs

Mergers, acquisitions, and cost-cutting strategies have led to downsizing and layoffs. Companies like Ford, GM, and Mercedes-Benz have reduced workforces and postponed certain programs. Many Tier 1 suppliers have restructured or declared bankruptcy.

f. Geopolitical Tensions

Tensions between major economies, such as US-China relations, the Russia-Ukraine war, and Brexit, have disrupted trade, increased tariffs, and created uncertainties in global investment and procurement strategies.

g. Post-COVID Market Correction

The COVID-19 pandemic had initially caused demand to plummet. However, post-pandemic recovery was not uniform. While there was a short-lived spike in demand in 2021–22, the market corrected itself by 2023, leaving a surplus of unsold inventory and unutilized talent.

Why Automotive Jobs Are Scarce

Hiring in the automotive industry has slowed down due to:

- Budget constraints within R&D and production teams

- Delayed projects in autonomous driving and EVs

- Focus on automation, reducing the need for manual intervention

- Reskilling requirements — traditional engineers may lack skills in software, AI, and data analytics

- Startups freezing operations due to a lack of funding

Sector-Wise Impact (OEMs, Tier 1, Tier 2)

- OEMs: Shifting focus to EV platforms; fewer job openings in ICE vehicle programs

- Tier 1 Suppliers: Impacted by OEM order cuts and forced to downsize

- Tier 2 Suppliers: Severely affected due to reduced overall volume and delayed projects

Global vs. Regional Differences

- India: Strong in IT and service support for global OEMs, but core R&D jobs have slowed

- Europe: Transition to EVs has created opportunities in green tech but removed ICE-related jobs

- US: Startups like Rivian and Lucid have paused hiring; big firms are restructuring

- China: Rapid EV adoption is fueling localized growth, but foreign firms face entry barriers

The Role of Automation and AI

Automation and AI are transforming vehicle design, manufacturing, and testing:

- Automated testing tools reduce the need for manual validation

- AI in predictive maintenance and design optimization reduces design-cycle manpower

- Digital twins and simulation replace physical testing in many cases

While these technologies increase efficiency, they reduce the demand for traditional job roles.

What Needs to Happen for Recovery

a. Stabilized Supply Chains: The industry needs a reliable and diversified semiconductor and parts supply. Countries are investing in local chip manufacturing, which might bear fruit by 2025.

b. Government Policies and EV Push: Government subsidies for EVs, scrappage policies, and emission regulations will fuel growth and push hiring.

c. Technological Maturity: When EVs, ADAS, and autonomous technologies mature, production will ramp up, opening jobs in software, validation, hardware design, and system integration.

d. Market Demand and Consumer Confidence: Lower inflation, rising incomes, and improved consumer confidence will lead to higher vehicle purchases, reviving the ecosystem.

When Will Huge Hiring Return?

While short-term hiring may remain muted through 2025, several signals indicate a bounce-back:

- 2026–2027: Expected recovery with increased EV production, charging infrastructure rollout, and ADAS adoption

- 2028 onwards: Boom period for software-defined vehicles (SDVs), cloud-based vehicle platforms, and V2X communication

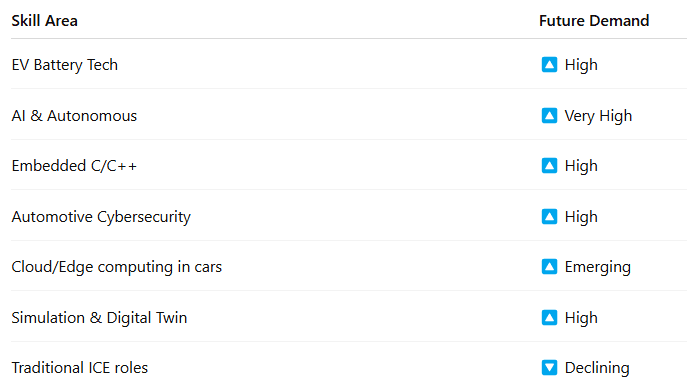

Hiring will be more prominent in:

- Embedded Software

- AUTOSAR, Functional Safety, and Cybersecurity

- Battery Management Systems

- Model-Based Development (MBD)

- HiL/SIL testing

- AI/ML for Autonomous Driving

Future Trends in Hiring (2025–2030)

How to Stay Prepared During the Downturn

- Upskill Constantly – Learn AUTOSAR, Python, Functional Safety, CAN, UDS, and MBD.

- Certifications – ISO 26262, ASPICE, Embedded Systems, AI in Automotive, etc.

- Project Portfolio – Build projects on EVs, BMS, HIL, or Autonomous Simulations.

- Network – Attend webinars, expos, and LinkedIn groups.

- Stay Updated – Follow industry updates from OEMs, suppliers, and startups.

Conclusion

Yes, the automotive industry is currently down, and jobs are scarce — but it’s not dead. This is a transformation phase, and every industry that evolves goes through it.

Those who adapt, learn, and invest in future skills will be the first to benefit when the boom begins — and that boom is coming, most likely between 2026 and 2028.

References

- McKinsey & Company Automotive Reports

- IEA – EV Outlook Reports

- S&P Global Mobility Trends

- Bosch, Continental, and ZF Annual Reports

- Semiconductor Industry Association Data

- LinkedIn Hiring Trends in Automotive

This was about “Why The Automotive Industry Is Down: No Automotive Jobs and When Will It Become Normal Again?”. Thank you for reading.

Also, read:

- 100 (AI) Artificial Intelligence Applications In The Automotive Industry

- 2024 Is About To End, Let’s Recall Electric Vehicles Launched In 2024

- 50 Advanced Level Interview Questions On CAPL Scripting

- 7 Ways EV Batteries Stay Safe From Thermal Runaway

- 8 Reasons Why EVs Can’t Fully Replace ICE Vehicles in India

- A Complete Guide To FlexRay Automotive Protocol

- Adaptive AUTOSAR Vs Classic AUTOSAR: Which One For Future Vehicles?

- Advanced Driver Assistance Systems (ADAS): How To Become An Expert In This Growing Field